HSBC | 2021

Cross Border Investment Account Opening Design

Overview

This Service Design case study shows the process of designing HSBC’s cross-border investment account opening service between Hong Kong and China, it involved designing cross-channel experiences on HSBC’s mobile app, backend system used by staff, and in-branch customer experience.

My role

Lead Product Designer for a team of 3 designers. I led cross-functional discovery workshops, defined the project scope, and introduced a user-centered design process for stakeholders.

Other designers focused on wireframes, customer journey map, and service blueprints.

Challenge

Under the previous regulation, Chinese customers needed to visit both China and Hong Kong branches to open an investment account for buying stocks in Hong Kong. COVID lockdowns made this impossible.

A new regulation allows the entire investment process to occur within the border, and a project team was formed to capture this opportunity.

Outcome

The project had processed $31M in transactions 2 months after launch.

Implemented User-Centered Design process, secured funding, and engaged 15+ key stakeholders in usability sessions

Design artifacts such as Service Blue Prints were widely adopted in Front-line and Operation teams.

Project challenge

A siloed working model

Before I joined this project team at HSBC, the departments worked in silos. They would write an SOP (Standard Operation Procedure) and only focus on the minimum operation changes they will perform and hope that hands-off between the upstream and downstream departments are smooth. They don’t have a clear overview of what the customer would experience in the whole end-to-end process.

Why this problem matters

HSBC was struggling with a delivery-focused mindset. For a complex project like this involving 30+ stakeholders across 8 departments across two borders, a lack of shared understanding on what the customer would be a recipe for disaster. If we continued this way, we would create a disjointed customer experience, leading to customer attrition.

Leadership challenge

Shifting the mindset from a delivery-focused business to a customer-centric approach was imperative. My goal was to illustrate to leadership that it's possible to effectively cater to customers while also aligning seamlessly with the overall business strategy.

In the journey's initial design, our goal was straightforward: provide customers with a means to open an investment account without leaving the border (see below list of features). However, our subsequent objective was more ambitious—to craft an experience that outshines competitors by delivering an effortless means of opening investment accounts.

-

Investment Account Opening

Money Transfer

Foreign exchange

Buy and sell investment products

Track and view product performance

Approach to introduce User-Centred Design process

To introduce User Centred Design processes to the wider organization, I focused on a few key steps:

Work with cross-functional team to establish alignment of the current end-to-end experience

Align on the future version with other key stakeholders

Gain buy-in from leadership for usability testing and demonstrate its value

Introducing User-Centred Design process

Creating a unified customer journey

I gathered the SOP from 8 departments and created my best understanding of the end-to-end investment account opening experience. My goal is to drive discussion around the current state of the customer journey and understand my representation of the end-to-end customer experience was correct.

Early pushback from stakeholders

I presented my initial draft to department leads, with the goal of gathering feedback and persuading them to join future co-creation workshops. However, I didn’t get the support I wanted based on a few reasons:

They are confused about why I am working on “Workflow charts” instead of focusing on designing the UX and UI, which is what they expected my role to be.

They didn’t see the value of the Customer Journey Map.

The initially detailed customer journey map was overwhelming for department leads.

Self-reflection — Creating a simplified customer journey map

Upon receiving feedback, I simplified the customer journey map into a two-page version, which resonated positively with leadership as they can clearly understand the end-to-end customer experience from a high-level. This streamlined approach secured buy-ins from various departments, enabling the creation of a detailed service blueprint with the participation of Subject Matter Experts in design lead workshops.

Creating a blueprint

Discovery workshop

My initial goal was to align stakeholders on the current journey state. We gathered insights from various sources, including customer research and market data.

We involved team members from different areas, who used sticky notes to map insights to develop a shared understanding of:

Which customer segment(s) is being targeted for this service?

What are their needs and expectations?

What are the typical steps customers take when exploring and initiating the account opening process?

What touchpoints or interactions do customers have with our brand during this journey?

Use a storyboard to align the future vision

I created a storyboard to help cross-functional stakeholders visualize the vision of the customer experience better and use it as a tool for high-level discussions.

Unlike PowerPoint presentations, a visual storyboard proves to be a more effective communication tool, as it fosters a deeper understanding of the experience vision.

Customer journey map

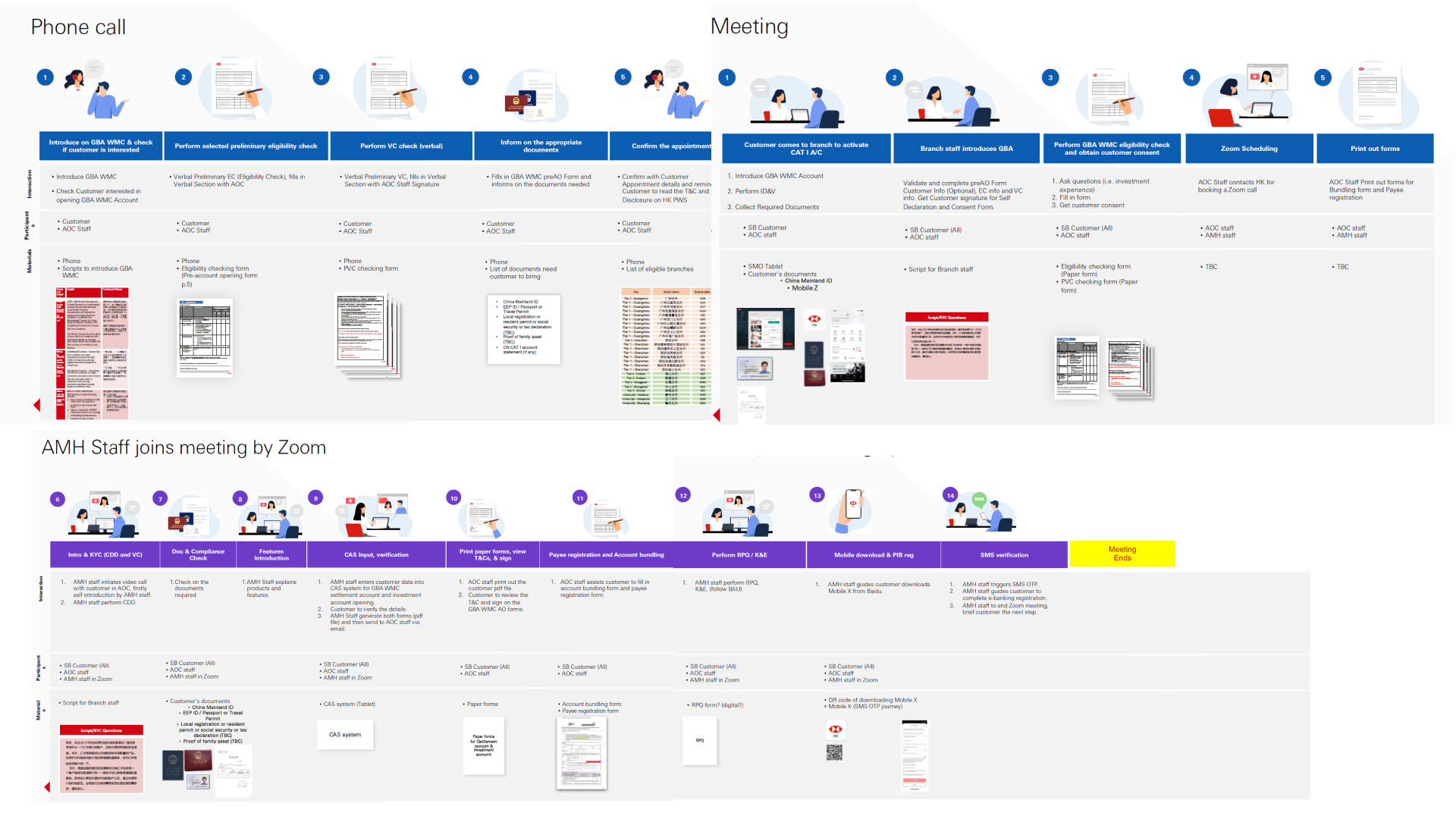

To build a strong foundation for the customer experience, it was important to align teams and market stakeholders with the future state of the journey.

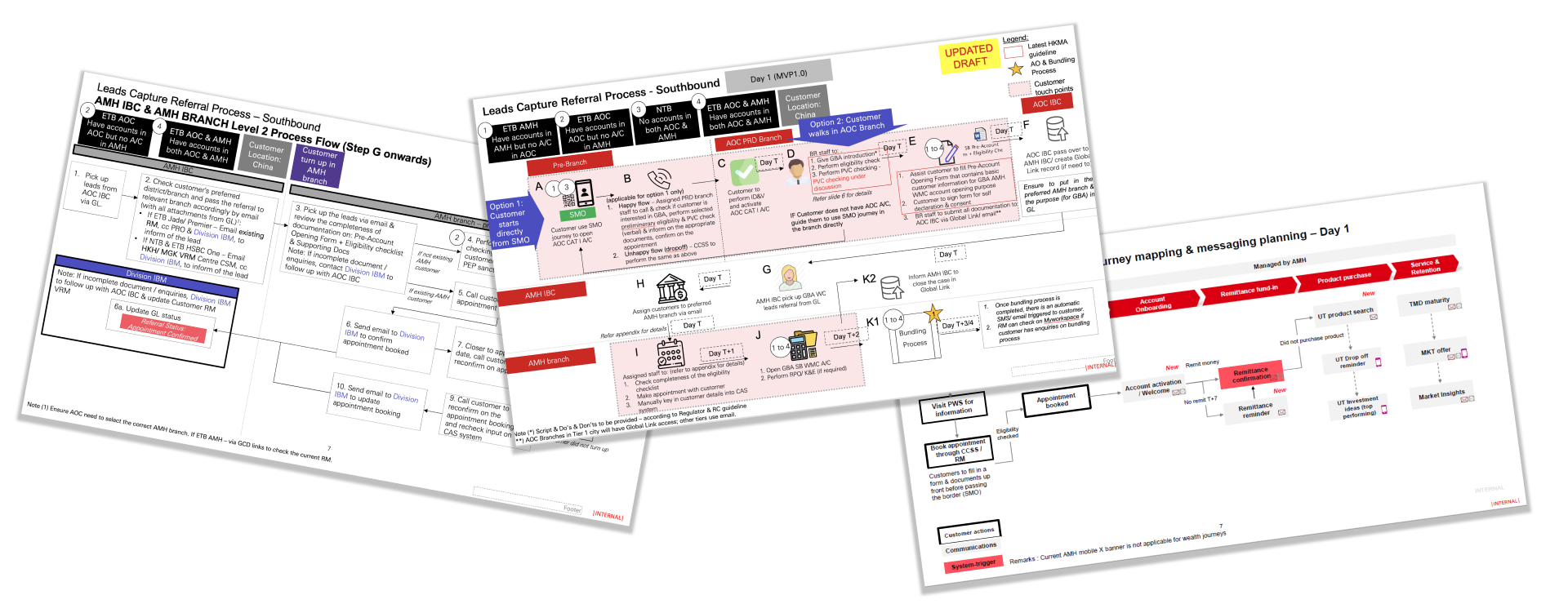

The service blueprint and customer journey map not only served as a driving force for alignment but also provided our technical and business teams with enough time to prepare business cases, APIs, and operational strategies ahead of time, offering us the strongest chance of delivering the best experience.

Staff Interviews and Service Blue Print

We interviewed the managers working at the branches and back-office to understand their tasks, roles, and daily schedules.

In the end, we produced a clear Service Blueprint that highlights the departments involved, the interaction, the platform, and the documentation required.

Test

Internal test for buy-in

I collaborated with staff early adopters, engaging them in role-playing sessions and uncovering over 20 issues in the initial proposal.

Ultimately, by emphasing the impact of increased support from leadership, we successfully secured the funding needed for a public usability test session.

Planning the research

Objective: Test whether the account opening experience matched customers' needs and expectations, identifying pain points or opportunities to enhance the experience.

Approach: We replicated the planned experience for opening an account and observed how it was perceived by participants in both Hong Kong and China.

Methodology: The research activity comprised a combination of interviews, role play, and follow-up questions. 6 participants and 2 staffs were invovled.

Make research a team sport

Throughout the project, my mission was to involve as many people in the design process as possible.

With support from early adopters in the staff department, I successfully persuaded 15+ key stakeholders to join live usability sessions.

Addressing problems

At this stage, we had over 25 problem statements covering the entire service journey, encompassing the stages before, during, and after the customer opens an investment account.

Our next move was to pinpoint opportunities in collaboration with the product team to shape our next iteration's scope. Tasks were assigned to respective owners, while the design team worked on improvements such as updating Service blueprints and addressing UX problems.

Deliverables

Detailed Customer journey map & Service blueprint

Simplified customer journey map

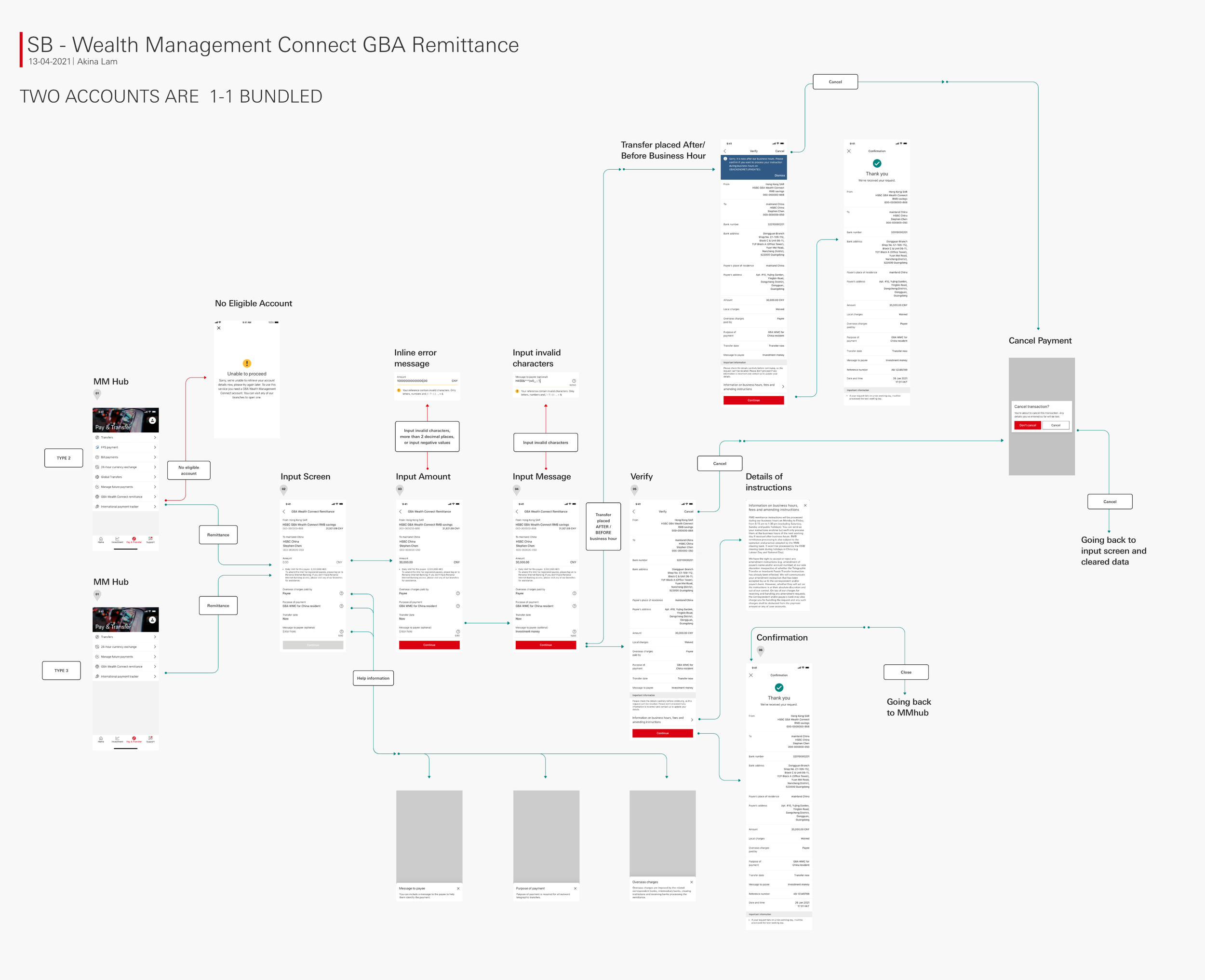

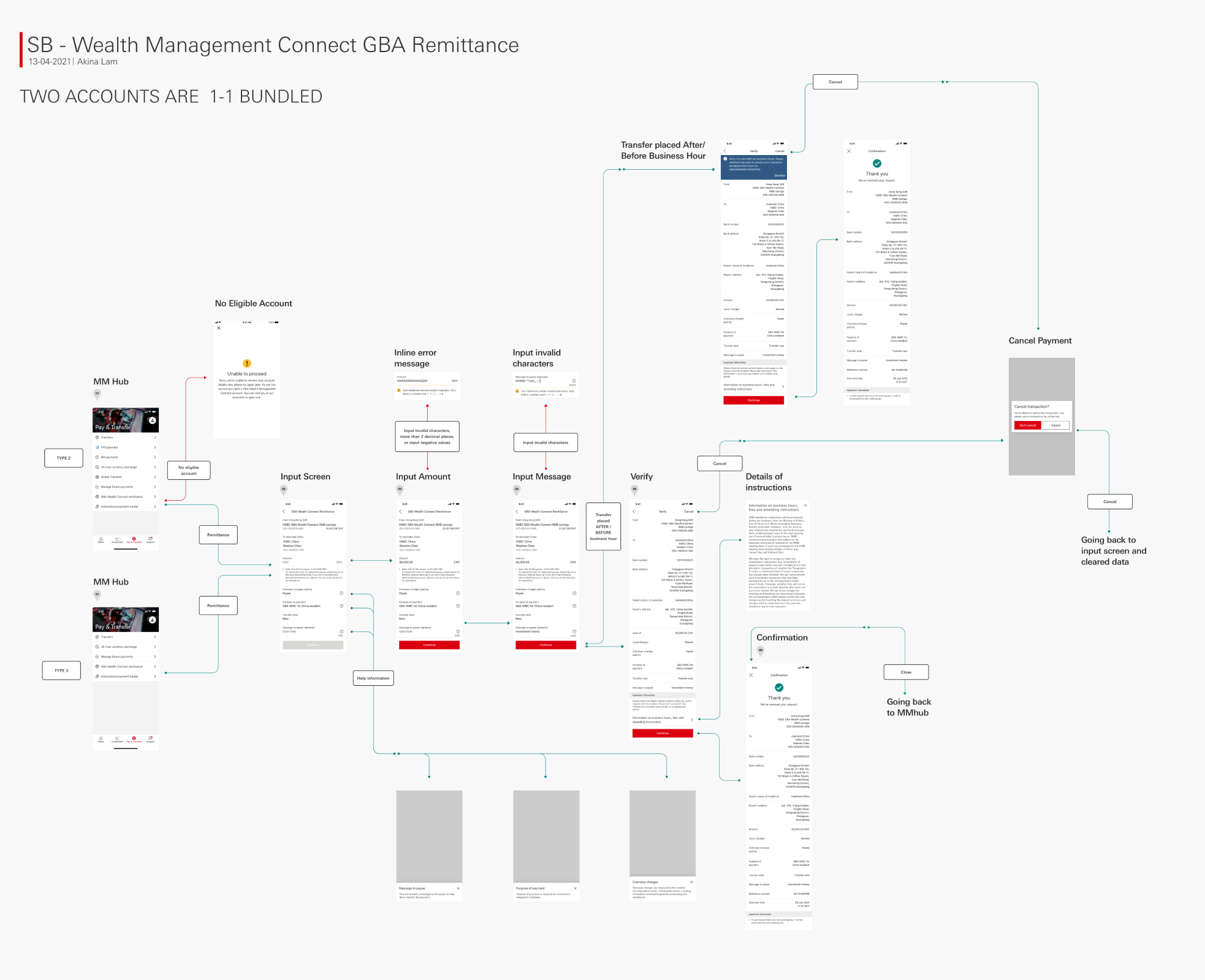

End-to-end wireframe

Integrate design artifacts into other departments

In our Service Blue Print (SBP), we have developed a visual language to highlight the steps the customers/staff are taking.

Since we worked closely with other teams, we have integrated our visual language into the Scripts and Training material, which they can cross reference with the SBP.

The feedback we received was overwhelmingly positive, with users expressing that our approach was considerably clearer than their previous methods.

Result

USD $31M

in 2 Months

The project has processed transactions worth more than USD 31M in 2 months after launch.

Management support

Implemented User-Centered Design, secured funding and engaged 15+ key stakeholders in usability sessions.

Praise from leadership (?)

Design Artifacts

Design artifacts such as Service Blue Prints were widely adopted in Training, Front-line, and Operation teams.

With the amazing work my team did, two amazing designers from my team were poached by the Head of Digital Transformation Team who collaborated with us on this project for a job offer. Luckily, they declined it!